Face-swiping Payment Market 2031 – Global Industry Growth, Trends, and Forecast to 2031

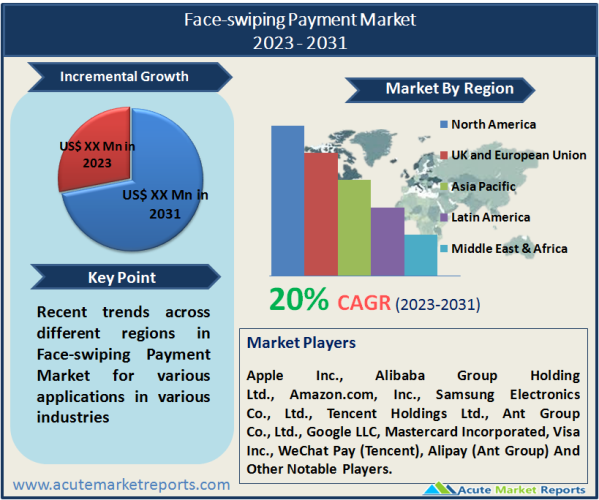

The market for face-swiping payments is anticipated to grow at a CAGR of 20% between 2023 and 2031, propelled by the increasing adoption of biometric authentication and contactless payment technologies. This inventive payment method enables users to conduct transactions using facial recognition technology alone, removing the need for physical cards or mobile devices. The market has experienced remarkable revenue growth, with a compound annual growth rate (CAGR) that reflects the increasing acceptability and popularity of face-swiping payments among consumers and businesses. Several factors have contributed to the growth of the face-swiping payment industry. Primarily, the convenience and rapidity offered by this technology have been major factors in its widespread adoption. Face-swiping payments allow users to quickly complete transactions by merely gazing at a camera or sensor, eliminating the need to transport physical cards or remember PINs. This frictionless and contactless experience is in line with the evolving preferences of consumers for frictionless and secure payment methods. In addition, the increased emphasis on security and fraud prevention has boosted demand for face-swiping payments. Face recognition technology provides a high level of authentication and security due to its reliance on distinctive facial characteristics and biometric information for identity verification. This improves the overall security of transactions and decreases the likelihood of fraudulent activity. In addition, the widespread adoption of face-swiping payments has been facilitated by the rising prevalence of smartphones and advanced camera technologies. With smartphones featuring front-facing cameras and robust facial recognition capabilities, this payment method is readily accessible via mobile devices. This accessibility has broadened the availability of face-swiping payments and made them more accessible to a larger user base.

The market’s adoption of face-swiping payments has been significantly influenced by their convenience and contactlessness. Using facial recognition technology, this payment method enables users to conduct transactions quickly and seamlessly, without the need for physical credentials or mobile devices. The ability to conduct transactions merely by looking at a camera or sensor provides consumers with a frictionless payment experience, thereby enhancing their convenience. Face-swiping payment services offered by major technology companies such as Apple Pay, Google Pay, and Alipay are becoming increasingly popular. These businesses have integrated facial recognition technology into their payment systems to enable contactless and convenient transactions, which have garnered widespread user acceptance.

Face-swiping payments have gained popularity due in large part to the importance placed on security and authentication. Utilizing unique facial characteristics and biometric data for identity verification, facial recognition technology offers a high level of safety. This decreases the likelihood of fraudulent activities and unauthorized account access. Face-swiping payments provide a higher level of security than traditional payment methods, which rely on physical cards or PINs that can be lost, stolen, or compromised. Demand for face-swiping payment solutions has been bolstered by the rising concern for data privacy and the requirement for comprehensive security measures. Smartphone manufacturers such as Apple have implemented sophisticated facial recognition technology (Face ID) in their devices, which not only enables secure unlocking but also enables secure face-swiping payments via their mobile payment platforms.

Browse for the report at: https://www.acutemarketreports.com/report/face-swiping-payment-market

The growth of face-swiping payments has been substantially influenced by technological advancements and the widespread adoption of smartphones. Users have easy access to this payment method due to the increasing availability of smartphones with sophisticated front-facing cameras and facial recognition capabilities. Smartphone manufacturers have invested significantly in the development of precise, quick, and dependable facial recognition technologies. These developments have expanded the user base for face-swiping payments. Face-swiping payments have expanded globally due to the increasing prevalence of smartphones, with users from various regions adopting this convenient and secure payment method. Face-swiping payment market growth is strongly influenced by the rising smartphone penetration rates and the continuous development of facial recognition technology.

Privacy and data security concerns are significant hindrances to the market for face-scanning payments. Some users have expressed concerns about the acquisition, storage, and possible misuse of their biometric data, despite the fact that facial recognition technology enhances security. Instances of data breaches and unauthorized access to personal information have raised concerns about the security of facial recognition systems. In addition, the use of facial recognition technology for payment purposes has raised concerns regarding privacy protection and the potential for surveillance. These worries have prompted debates and regulatory scrutiny regarding the use of facial recognition technology in numerous nations. For example, the General Data Protection Regulation (GDPR) of the European Union has imposed stringent regulations on the collection and processing of biometric data. The reluctance of users to share facial data and their concerns regarding data security and privacy may impede the widespread adoption of face-swiping payments unless robust measures are implemented to resolve these concerns and guarantee transparent data handling practices.

Get a free sample copy from https://www.acutemarketreports.com/request-free-sample/139637

The face-swiping payment market is divided into two primary segments: payment apparatus and payment systems. In contrast to the payment equipment segment, which concentrates on the hardware components required for face-swiping transactions, the payment systems segment includes the software and infrastructure for secure transaction processing. The increasing adoption of facial recognition technology in various industries, including retail, hospitality, and finance, is the primary factor driving the demand for payment equipment. These devices allow businesses to process face-swiping payments and provide customers with a seamless payment experience. Due to the growing adoption and integration of face-swiping payment solutions across various industries, the payment equipment segment is anticipated to experience a CAGR during the period from 2023 to 2031. The need for secure and efficient transaction processing, as well as integration with existing payment networks and platforms, drives the demand for payment systems. This segment generated considerable revenue in 2022, as businesses and consumers increasingly adopted face-swiping payment solutions.

The face-swiping payment market includes retail, restaurant, travel, and other application segments. In 2022, the retail segment had the highest revenue contribution. The retail industry is one of the most prominent applications for face-swiping payments. Retailers are increasingly adopting this payment method in order to provide consumers with a seamless and contactless payment experience. Face-swiping payments enable consumers to make purchases using facial recognition alone, eliminating the need for physical cards or mobile devices. The adoption of face-swiping payments is anticipated to increase substantially in the retail industry due to the convenience it provides to both customers and retailers. The travel segment is anticipated to experience the highest CAGR between 2023 and 2031. Face-scanning payments are also being adopted by the travel industry to improve the payment experience for travelers. Face-swiping payments offer a convenient and secure method for transactions in the travel industry, from airline tickets to hotel reservations. By eliminating the need for physical cards or authentication via mobile devices, travelers are able to make payments quickly and securely, reducing the burden of transporting multiple payment options. The adoption of face-swiping payments is anticipated to increase in the travel industry as travelers prioritize contactless and seamless payment experiences.

The face-swiping payment market in North America has grown significantly due to the region’s advanced technological infrastructure and high consumer approval of innovative payment solutions. The presence of major technology firms and the early adoption of facial recognition technology in industries such as retail and hospitality contribute to the expansion of the market. In 2022, North America held a significant revenue share of the global market, with the United States leading in terms of revenue share. Due to its large population, expanding digital infrastructure, and rising disposable income of consumers, the Asia-Pacific region contains enormous potential for the face-swiping payment market. Countries such as China, Japan, and South Korea are at the forefront of technological innovations, such as facial recognition technology. This region’s market is developing due to the increasing prevalence of mobile payments and the increasing popularity of contactless transactions. Among all regions, Asia-Pacific is anticipated to exhibit the highest CAGR from 2023 to 2031, reflecting the region’s robust market potential.

Access all other popular reports from https://www.acutemarketreports.com/category/technologies-market

The market for face-swiping payments is characterized by intense competition among key participants seeking to capitalize on the rising demand for convenient and secure payment solutions. These competitors utilize a variety of strategies to obtain a competitive advantage and strengthen their market position. The market for face-swiping payments is dominated by tech titans, financial institutions, and up-and-coming firms. These companies have established a firm presence and made substantial investments in R&D to improve their facial recognition technology and payment platforms. Apple Inc., Alibaba Group Holding Ltd., Amazon.com, Inc., Samsung Electronics Co., Ltd., Tencent Holdings Ltd., Ant Group Co., Ltd., Google LLC, Mastercard Incorporated, Visa Inc., WeChat Pay (Tencent), and Alipay (Ant Group) are key players in the face-swiping payment market. Key participants in the face-swiping payment market are committed to advancing their facial recognition systems’ precision, speed, and security through continuous technological innovation. These companies’ investments in artificial intelligence (AI) and machine-learning algorithms allow them to improve their face recognition capabilities and provide seamless payment experiences. The market for face-swiping payments is likely to see sustained advances in facial recognition technology, resulting in increased precision and dependability. As the market matures, regulatory frameworks governing the acquisition and utilization of biometric data will play a significant role in shaping the industry. In addition, the increasing prevalence of smartphones, e-commerce, and digital payment transactions will drive the demand for face-swiping payment solutions.

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com